If you’re in the trucking industry, you know that staying compliant with fuel tax regulations is a must. The International Fuel Tax Agreement (IFTA) simplifies fuel tax reporting for interstate carriers, but filing can still be a complicated and time-consuming task. Between tracking fuel purchases, calculating miles per state, and submitting reports on time, it’s easy to feel overwhelmed.

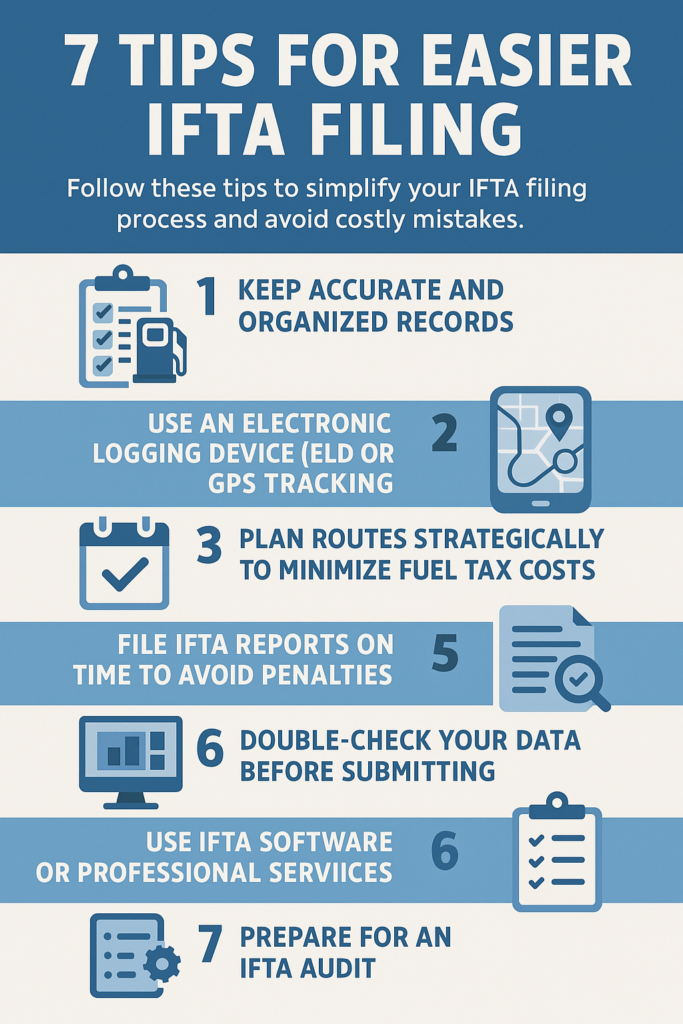

To make your IFTA filing process smoother and avoid costly mistakes, we’ve compiled seven practical tips that every trucker and fleet manager should follow. By implementing these strategies, you can save time, reduce stress, and stay compliant with IFTA regulations.

For professional filing assistance, check out the IFTA service.

1. Keep Accurate and Organized Records

One of the biggest reasons trucking companies struggle with IFTA compliance is poor record-keeping. Keeping detailed and organized records of fuel purchases and mileage is essential for an error-free filing process.

What You Should Track:

- Fuel receipts (paper or digital)

- Odometer readings at each state line

- Trip logs with start and end locations

- Total miles traveled per state

Best Practices for Record-Keeping:

- Store all receipts and logs in a digital format to prevent loss or damage.

- Use folders or spreadsheets to categorize fuel expenses and mileage reports.

- Keep records for at least four years in case of an audit.

By keeping everything organized, you’ll have everything you need when it’s time to file your IFTA reports.

2. Use an Electronic Logging Device (ELD) or GPS Tracking

Manually tracking mileage can be tedious and prone to errors. That’s why many trucking businesses invest in ELDs and GPS tracking systems to automate record-keeping.

How Technology Helps:

- Automatically logs miles traveled per jurisdiction

- Tracks fuel purchases and integrates with accounting software

- Reduces errors that come with manual tracking

Investing in a good ELD or GPS system can save you hours of work and improve accuracy when filing IFTA reports.

3. Plan Routes Strategically to Minimize Fuel Tax Costs

Did you know that fuel tax rates vary by state? If you’re not careful, you could end up paying more in taxes than necessary.

Tips for Smart Route Planning:

- Compare state fuel tax rates before your trip.

- Buy fuel in states with lower tax rates, but make sure to track miles correctly.

- Use route optimization tools to find the most efficient path and reduce unnecessary miles.

By planning ahead, you can reduce expenses while staying compliant with IFTA.

4. File IFTA Reports on Time to Avoid Penalties

IFTA reports are due four times a year, and missing a deadline can result in fines and penalties. The due dates are:

- April 30 (for January-March)

- July 31 (for April-June)

- October 31 (for July-September)

- January 31 (for October-December)

How to Stay on Schedule:

- Set up calendar reminders for each filing deadline.

- Prepare your reports a week in advance to avoid last-minute stress.

- Use IFTA filing services like this one to ensure compliance.

Filing on time keeps your business running smoothly and avoids unnecessary fines.

5. Double-Check Your Data Before Submitting

Mistakes in IFTA reports can trigger audits, delays, and extra fees. Even small errors—like missing fuel receipts or incorrect mileage—can lead to compliance issues.

Common Filing Mistakes to Avoid:

- Forgetting to include out-of-state miles

- Miscalculating fuel tax rates

- Entering incorrect odometer readings

Before submitting your report, take a few minutes to review all numbers carefully and verify their accuracy.

6. Use IFTA Software or Professional Services

If you manage a fleet or simply want to reduce your workload, IFTA software or professional filing services can make the process much easier.

Benefits of IFTA Software:

- Automates calculations based on fuel purchases and mileage

- Integrates with ELDs for accurate tracking

- Generates reports instantly for quick filing

Alternatively, using an IFTA filing service ensures that experts handle your reports, reducing your risk of errors and penalties. Check out the IFTA service to simplify your filing process.

7. Prepare for an IFTA Audit

Even if you follow all the rules, your business may still be selected for an IFTA audit. Preparing ahead of time will help you pass without issues.

How to Be Audit-Ready:

- Keep detailed records for at least four years

- Ensure trip logs match fuel receipts

- Have backup copies of all documents

If your records are accurate and complete, you won’t have to worry about failing an audit.

Final Thoughts

Filing IFTA reports doesn’t have to be a headache. By keeping accurate records, using technology, planning routes wisely, and filing on time, you can simplify the process and avoid costly mistakes.

If you need help with your IFTA filing, consider using a professional service like this one to ensure compliance and peace of mind.

Following these seven tips will make your IFTA filing process faster, easier, and stress-free!